SCHEDULE 14A INFORMATIONTable of Contents

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

EXCHANGE ACT OFSCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (AMENDMENT NO.(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ☑ | Filed by the Registrant | ☐ |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| Confidential, |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

AIR PRODUCTS AND CHEMICALS, INC.Air Products and Chemicals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | ||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

| 1) Title of each class of securities to which transaction applies: |

| 2) Aggregate number of securities to which transaction applies: |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 |

| 4) Proposed maximum aggregate value of transaction: |

| 5) Total fee paid: |

| Fee paid previously with preliminary | |||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |||

| 1) Amount |

| 2) Form, Schedule or Registration Statement No.: |

| 3) Filing Party: |

| 4) Date Filed: |

Proxy Statement for

2019Annual Meeting

of Shareholders

Thursday, January24, 2019

2:00p.m. (Eastern Time)

Corporate Headquarters Auditorium

7201Hamilton Boulevard

Allentown, PA18195

Sustainability at Air Products

Providing innovative solutions through deeply-rooted values

|  |  | ||

Growresponsibly through sustainability-driven opportunities that benefit our customers and our world. | Conserveresources and reduce environmental footprints through cost-effective improvements. | Carefor our employees, customers and communities — protecting our ability to operate and grow. | ||

|  |  | ||

We help customers improve their sustainability performance through higher productivity, better quality products, reduced energy use and lower emissions. | We set aggressive environmental performance goals for greenhouse gases, energy, water and our fleet, and we measure progress to continually improve our own operations. | We continue to nurture a culture of safety, simplicity, speed and self-confidence. Our goal is zero accidents and zero incidents. We are committed to developing our people, supporting our communities, engaging suppliers and upholding our integrity. |

| The Company was named to the Dow Jones Sustainability Index (North America), FTSE4Good Index, Ethibel Sustainability Index (Excellence Global) and Corporate Responsibility Magazine’s 100 Best Corporate Citizens. For the Company’s diversity and inclusion initiatives, it was named a 2018 DiversityInc Noteworthy Company and as a Corporate Equality Index Best Place to Work for LGBT Equality. |

Message to Our Shareholders |

|

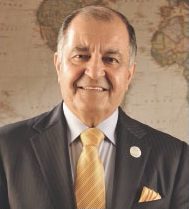

“As we take our Five-Point Plan to the next phase of our journey, our goal remains the same: to be the safest, most diverse and most profitable industrial gas company in the world, providing excellent service to our customers.” |

December 12, 2018 | ||

Dear Fellow Shareholder: | ||

On behalf of the Board of Directors, I am pleased to invite you to attend the 2019 Annual Meeting of Shareholders of Air Products and Chemicals, Inc. to be held at 2:00 p.m. (Eastern Time), Thursday, January 24, 2019, at the Company’s headquarters at 7201 Hamilton Boulevard, Allentown, Pennsylvania. Admission procedures are explained in the attached proxy statement, and directions appear on the last page of these materials. We have arranged to keep parking and navigating our facilities easy for you. I hope you will be able to join us. | ||

Attached you will find a Notice of Annual Meeting and proxy statement that contains additional information, including the items of business and methods you can use to vote your proxy, such as the telephone or Internet. Your vote is important. I encourage you to sign and return your proxy card or use Internet, mobile device or telephone voting prior to the meeting, so that your shares of common stock will be represented and voted at the meeting, even if you cannot attend. | ||

Over the past several years, our talented and dedicated employees have made Air Products the safest and most profitable industrial gas company in the world with the strongest balance sheet. Our strategic Five-Point Plan guided that success and has positioned us for tremendous growth. | ||

Now, we have taken the Five-Point Plan to the next phase of our journey: | ||

| 1. | Sustain the lead.To sustain our lead, we will uphold our focus on safety, diversity, profitability and drive to be best-in-class operationally, in everything that we do. | |

| 2. | Deploy capital.Over the next five years, we have at least $15 billion of capital to commit to high quality industrial gas projects. We are focused on energy, environmental and emerging markets. | |

| 3. | Evolve portfolio.As we deploy capital, we are evolving our portfolio to focus on more large, on-site projects, and we are creating step-change growth opportunities through syngas/gasification and complex megaproject execution. | |

| 4. | Change culture.We are continuing to drive our culture change, building an inclusive and collaborative team that works together and wins together around the world. | |

| 5. | Belong and matter.Finally, as we work hard every day to create value for our shareholders, we are also fulfilling our higher purpose: creating a work environment where people belong and matter, producing products that improve the environment and our customers’ processes and promoting collaboration among people of different cultures and backgrounds all over the world. | |

All the best,

Seifi Ghasemi | ||

| i |

Notice of Annual Meeting of Shareholders |

| Logistics |

Date and Time Thursday, January 24, 2019 2:00 p.m. (Eastern Time) |

Location Corporate Headquarters Auditorium 7201 Hamilton Boulevard Allentown, PA |

Record Date Shareholders of record at the close of business on November 30, 2018 are entitled to receive this notice and to vote at the meeting. |

Admission Free parking will be available. Admission procedures are explained on page 60. Directions appear on the last page of this proxy statement. |

Important Notice Regarding Internet Availability of Proxy Materials for the Air Products and Chemicals, Inc. 2019 Annual Meeting of Shareholders: Our proxy statement and 2018 Annual Report to Shareholders are available at www.proxyvote.com. |

| Items of Business |

| Board Vote Recommendation | Votes Required | Page | |

| Proposal 1.Elect the eight nominees proposed by the Board of Directors as directors for a one-year term ending in 2020. |  For For | Majority of Votes Cast | 1 |

| Proposal 2.Conduct an advisory vote on executive officer compensation. |  For For | Majority of Votes Cast | 17 |

| Proposal 3.Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2019. |  For For | Majority of Votes Cast | 51 |

Shareholders will also attend to such other business as may properly come before the meeting or any postponement or adjournment of the meeting.

| How to Vote |

Shareholders of Record(shares registered in your name with the Company’s transfer agent) andRetirement Savings Plan Participants:

|

|

|

|

| ||||

Internet www.proxyvote.com | Mobile Device Scan the QR Code to vote using  | Telephone 1-800-690-6903 | Mail Complete, sign and mail your proxy card or voting instruction form in the self-addressed envelope provided. | In Person For instructions on attending the 2019 Annual Meeting in person, please see page 60. |

December 14, 2016Street Name Holders(shares held through a broker, bank or other nominee): Refer to voting instruction form.

Important |

Whether you plan to attend the meeting or not, please submit your proxy as soon as possible in order to avoid additional soliciting expense to the Company. The proxy is revocable and will not affect your right to vote in person if you attend the meeting.

Dear Fellow Shareholder:

On behalfBy order of yourthe Board of Directors, I am pleased to invite you to attend the 2017 Annual Meeting

Sean D. Major

Executive Vice President, General Counsel and Secretary

December 12, 2018

| ii |

Attached you will find a Notice of Annual Meeting and Proxy Statement that contains additional information about the meeting, including the items of business and methods that you can use to vote your proxy, such as the telephone or Internet. Your vote is important. I encourage you to sign and return your proxy card or use telephone or Internet voting prior to the meeting, so that your shares of common stock will be represented and voted at the meeting even if you cannot attend.

I am very proud of what the Air Products team has accomplished over the last year. We have made significant progress towards achieving our goal of being the safest industrial gas company in the world and this year we met our objective of being the most profitable. I look forward to meeting with fellow shareholders in January to answer your questions about our progress.

Cordially,

Seifi Ghasemi

Chairman, President, and Chief Executive OfficerContents

HIGHLIGHTS OF 2016 PROXY STATEMENT

Proxy Statement Highlights |

This section summarizes information contained elsewhere in the proxy statement. These highlights do not contain all the information that you should consider before voting or provide a complete description of the topics covered. Please read the entire proxy statement before voting.

Meeting InformationFiscal 2018 Company Performance Highlights

| Financial Performance |

| EARNINGS PER SHARE | |

| |

| |

| Increased 28% over fiscal 2017. |

| ADJUSTED EARNINGS PER SHARE1 | ||

| ||

| ||

| |

over fiscal 2017, representing the fourth consecutive year of double-digit growth. |

| |||

| |||

Items of Business

| OPERATIONS | ||||||

| ||||||

| |

over fiscal 2017. |

| ADJUSTED EBITDA1 | ||

| ||

| |

over fiscal 2017. |

|

| Safety Performance |

| The Company continued its improvement in safety performance, with 71% improvement in the employee lost time injury rate and 50% improvement in the employee recordable injury rate versus fiscal 2014 and even greater improvement in contractor injury rates. |

|

| Operational Performance |

| The Company brought major projects on-stream in China, Korea and the U.S. and announced four large gasification projects and the acquisition of gasification technology. |

|

| Returns to Shareholders |

| The Company returned nearly $900 million to shareholders through dividends, increasing dividends for the 36th consecutive year. |

| 1 | This is a non-GAAP financial measure. See Appendix A for a reconciliation to the most directly comparable financial measure calculated under GAAP. |

| iii |

Proxy Statement Highlights

PROPOSAL | Elect the eight nominees proposed by the Board of Directors as directors for a one-year term ending in | |||||||

| The Board recommends a vote | |||||||

| ||||||||

| ||||||||

Director Nominees

| Page 1 | |||||

The individuals nominated for election to the Board are all current directors and possess a broad range of qualifications and skills that facilitate strong oversight of Air Products’ management and strategy. Our directors have diverse backgrounds and experiences and have demonstrated a commitment to strong corporate governance, shareholder engagement and sustainability. | |||||

| Director Nominees |

| Committees | ||||||||||||

| Name and Current or Previous Position | Independent | Diverse | Tenure (Full Years) | AF | CGN | E | MDC | |||||

Susan K. Carter | Senior Vice President and Chief Financial Officer of Ingersoll-Rand | ● | ● | 7 |  |  | ||||||

Charles I. Cogut | Retired Partner, | ● | 3 |  |  | |||||||

| ● | 8 | ● |  |  | |||||||

| Seifollah Ghasemi Chairman, President and Chief Executive Officer of Air Products and Chemicals, Inc. | ● | 5 | ● | |||||||||

| ||||||||||||

David H. Y. Ho | Chairman and Founder of Kiina Investment Ltd. | ● | ● | 5 |  |  | ||||||

Margaret G. McGlynn | Retired President and Chief Executive Officer of International AIDS Vaccine | ● | ● | 13 |  |  | ||||||

Edward L. Monser | Retired President and Chief Operating Officer, Emerson Electric Co. | ● | 5 |  |  | ● | ||||||

Matthew H. Paull | Retired Senior Executive Vice President and Chief Financial Officer of McDonald’s | ● | 5 | ● |  |  | ||||||

| AF | Audit and Finance | CGN | Corporate Governance and Nominating | ● Chair | ||||||

| E | Executive | MDC | Management Development and Compensation |  Member Member |

| iv |

2016 Company Performance HighlightsTable of Contents

The Company continued its dramatic improvement in safety performance, with 20% improvement in the lost time injury rate and 12% improvement in the recordable injury rate.

Proxy Statement Highlights

| Board Snapshot |

Independence |

|

|

| Director Qualifications and Skills |

The Board possesses a broad range of qualifications and skills that facilitate strong oversight of Air Products’ management and strategy. The following matrix identifies the primary skills that the Corporate Governance and Nominating Committee and the Board considered in connection with the re-nomination of the current directors.*

| Carter | Cogut | Deaton | Ghasemi | Ho | McGlynn | Monser | Paull | ||

| Accounting/Financial Reporting | ● | ● | ● | ● | ● | |||

| Corporate Governance | ● | ● | ● | ● | ● | ● | ● | |

| Diverse Director | ● | ● | ● | ● | ||||

| Electronics Industry | ● | ● | ● | ● | ● | ● | ||

| Executive Leadership | ● | ● | ● | ● | ● | ● | ● | |

| Finance and Capital Management | ● | ● | ● | ● | ● | |||

| Government Experience | ● | ● | ● | ● | ● | |||

| Industry/Operations | ● | ● | ● | ● | ● | |||

| Information Technology | ● | ● | ● | |||||

| International Experience | ● | ● | ● | ● | ● | ● | ● | ● |

| Investor Relations | ● | ● | ● | ● | ● | |||

| Legal | ● | |||||||

| Logistics Experience | ● | ● | ● | ● | ||||

| Mergers & Acquisitions | ● | ● | ● | ● | ● | ● | ● | |

| Technology | ● | ● | ● | ● | ● | |||

| Oil and Gas Experience | ● | ● | ● | ● | ||||

| * | The absence of a mark does not necessarily indicate that the director does not possess that qualification or skill. |

| v |

Proxy Statement Highlights

Shareholder Engagement |

The Board believes that fostering long-term and institution-wide relationships with shareholders, listening to their concerns and maintaining their trust and goodwill is a prerequisite to good governance.

| Management conducts extensive engagements with key shareholders. |  | These engagements include discussions about governance, compensation and safety, as well as financial and operational matters, to ensure that management and the Board understand and address the issues that are important to our shareholders. |  | The Board oversees the discharge by management of shareholder communication and engagement and receives regular reports on shareholder comments and feedback and is open to dialogue on issues of interest to significant shareholders. |  | The Board also specifically seeks to understand any significant voting trends on the Company’s executive officer compensation program and other governance matters. |

| Sustainability |

The Board of Directors has accountability for oversight of our environmental and safety performance, which it reviews at least quarterly. The Corporate Governance and Nominating Committee has responsibility for monitoring our response to important public policy issues, including sustainability, which is reviewed on a routine basis. Business ethics, climate change and talent management are key subjects related to sustainability that are discussed by the Board. The Board also reviews our progress against our 2020 Sustainability Goals that are related to growing our business through products that benefit people and the environment, conserving resources and reducing our environmental footprint, and caring for our employees, customers and communities. Further, the Management Development and Compensation Committee has structured our compensation program to balance financial results with other Company values such as sustainability, safety, diversity and ethical conduct. We also have engaged with our shareholders on sustainability matters.

For information about how we manage sustainability, including our 2020 Sustainability Goals, and to access our 2018 Sustainability Report, please visit the sustainability page of our website.

| |||

2018 Corporate Sustainability Report* | |||

| * | The information on the sustainability webpage is not incorporated by reference into, and does not form part of, this proxy statement. | ||

| vi |

Proxy Statement Highlights

PROPOSAL | Conduct an advisory vote on executive officer compensation. | ||||

| The Board recommends a vote “FOR” this item. |  | Page 17 | ||

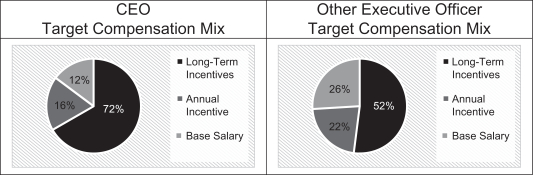

As described in the Compensation Discussion and Analysis, our executive officer compensation program has been designed to support our long-term business strategies and drive creation of shareholder value. It is aligned with the competitive market for talent, sensitive to Company performance and oriented to long-term incentives to maintain and improve the Company’s long-term profitability. We believe the program delivers reasonable pay which is strongly linked to Company performance. | |||||

| Fiscal 2018 Compensation Highlights |

| ● | Median Pay Program.The executive officer compensation program is designed to deliver compensation that approximates the median for a carefully selected peer group and that exceeds the median when performance exceeds expectations. In Fiscal 2018, the Management Development and Compensation Committee determined that it was appropriate to increase the base compensation of our Chief Executive Officer (“CEO”) to keep Mr. Ghasemi competitive with the market due to his excellent performance over his first three years as CEO. Previously, base salary was positioned at median. As a result of this base salary increase, our CEO’s compensation was positioned at the 75th percentile across all pay elements. |

| ● | Shareholder Focused Performance Metrics.Fiscal 2018 executive officer incentive compensation performance metrics support the Company’s priorities for creation of shareholder value. |

Say on Pay Support At the January 2018 Annual Meeting of Shareholders, our shareholders supported the Company’s executive officer compensation program by a vote of approximately 96.5%of the votes cast. |

| vii |

Proxy Statement Highlights

Below is a summary of the components of direct compensation for fiscal 2018 delivered to our CEO and our other named executive officers.

|

| Other | Key Terms |

|

AIR PRODUCTS AND CHEMICALS, INC.

i

|

|  |  | ●Target at Market Median with adjustment based on level of responsibility, experience, and individual performance | ||

Annual Incentive |  |  | ●Target payout references Market Median ●Actual payout driven by adjusted EPS ●10% Growth required for target payout | |||

| Long-Term Incentives |  |  | ●Target value based on Market Median for long-term incentives | ||

Performance Shares |  |  | ●Actual payout based on relative TSR over ●50thpercentile required for | |||

Restricted Stock Units |  |  | ● ● |

Pay and Performance Alignment |

The Company completed its spin-offBelow is the Equilar Inc. Pay for Performance Profile for 2015-2017 reported periods comparing Air Products’ CEO compensation and total shareholder return (“TSR”) to that of the Electronicmembers of the S&P 500 Basic Materials business with the distribution of all outstanding shares of Versum Materials, Inc. (“Versum Materials”) to shareholders on October 1, 2016.

The Company announced it had entered into a definitive agreementSector for the salepast three years (reflects TSR for calendar years 2015-2017 and Summary Compensation Table total compensation for CEOs and CEO Conference Board Realizable Pay for fiscal years ending with or within calendar years 2015-2017).

|  | |

CEO Total Compensation | CEO Realizable Pay |

| viii |

Table of its Performance Materials business for $3.8 billion.Contents

The Company was named to the Dow Jones Sustainability Index (North America), the CDP Climate Change Leadership, the FTSE4Good Index, the Ethibel Sustainability Index (Excellence Global) and Corporate Responsibility Magazine’s 100 Best Corporate Citizens.

2016 CompensationProxy Statement Highlights

At the January 2016 Annual Meeting of Shareholders, shareholders supported the Company’s Executive Officer compensation program by a vote of 98% of the votes cast.

Compensation Governance Best Practices |

The Management Development and Compensation Committee modifiedrecognizes that shareholders want assurance that the Executive Officer long term incentiveprocesses for determining and paying executive officer compensation mix for 2016 to tie more compensation directly to shareholder returns:

| Award Type | 2015 | 2016 | ||||||

Performance Shares | 55 | % | 60 | % | ||||

Restricted Stock | 25 | % | 40 | % | ||||

Stock Options | 20 | % | 0 | % | ||||

Incentive compensation performance metrics supportreflect thoughtful stewardship of the Company’s priorities for creation of shareholder value:resources. The Committee has adopted the following practices, among others, to demonstrate its commitment to this principle:

COMPENSATION GOVERNANCE HIGHLIGHTS | ||

|

| |

|

AIR PRODUCTS AND CHEMICALS, INC.

ii

Notice of Annual Meeting of Shareholders

●Independent directors make final compensation decisions pertaining to executive officers. ●The Committee is advised by an independent compensation consultant. ●Executive sessions are held at all Committee meetings. ●Compensation is targeted at median for similar industrial companies. ●Stringent stock ownership guidelines. ●Prohibition on hedging or pledging Company stock. ●Consistent administration of performance goals andformulas. ●Annual review of dilution and burn rate relative topeers. ●Double-trigger change in control arrangements. ●Clawback Policy adopted to combat executive officermisconduct and reclaim certain awards and incentives. |

|

|

2:00 p.m. (Eastern Standard Time)

|

| ||

7201 Hamilton Boulevard

Allentown, PA 18195

|

|

|

|

|

|

|

|

|

|

|

|

|

By order of the Board of Directors,

Mary T. Afflerbach

Vice President, Corporate Secretary, Chief

Governance Officer and General Counsel (Interim)

December 14, 2016

|

iii

PROXY STATEMENT

| The Board recommends a vote “FOR” this item. |  | Page 51 | ||

The Audit and Finance Committee selected Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for fiscal 2019 following a competitive selection process and careful consideration of each participating firm’s demonstrated qualifications. The Board believes that the engagement of Deloitte as our independent registered public accounting firm for fiscal 2019 is in the best interests of shareholders and is submitting the appointment of Deloitte to our shareholders for ratification as a matter of good corporate governance. | |||||

In 2018, the Audit and Finance Committee of the Board of Directors conducted a competitive process to select the Company’s independent registered public accounting firm for the Company’s 2019 fiscal year. Following review and evaluation of proposals from the firms participating in that process, the Audit and Finance Committee engaged Deloitte. Our prior independent registered public accounting firm, KPMG LLP (“KPMG”), audited the financial statements included in our Annual Report on Form 10-K for the year ended September 30, 2018. This proposal requests that our shareholders ratify the Audit and Finance Committee’s appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending September 30, 2019.

| ix |

Table of Contents |

QUESTIONS AND ANSWERS ON VOTING AND THE ANNUAL MEETING

AIR PRODUCTS AND CHEMICALS, INC.

PROXY STATEMENT

We have provided you this Notice of Annual Meeting and Proxy Statement because the Board of Directors (the “Board”) of Air Products and Chemicals, Inc. (the “Company” or “Air Products”) is soliciting your proxy to vote at the Company’s Annual Meeting of Shareholders on January 26, 2017 (the “Annual Meeting”). This Proxy Statement contains information about the items to be voted on at the Annual Meeting and information about the Company. Instructions on how to access this Proxy Statement and our Annual Report on Form 10-K on the Internet or paper copies of the Proxy Statement and Annual Report are first being sent to shareholders on or about December 14, 2016.

QUESTIONS AND ANSWERS ON VOTING AND

THE ANNUAL MEETING

How many shares can vote at the Annual Meeting?

As of the Record Date, which was November 30, 2016, 217,433,579 shares of Company common stock were issued and outstanding, which are the only shares entitled to vote at the Annual Meeting. Every owner of Company stock is entitled to one vote for each share owned.

Who counts the votes?

A representative of Broadridge Corporate Issuer Solutions, Inc. will tabulate the votes and act as the independent inspector of election.

What is a proxy?

A proxy is your legal appointment of another person to vote the shares of Company stock that you own in accordance with your instructions. The person you appoint to vote your shares is also called a proxy. You can find an electronic proxy card atwww.proxyvote.com that you can use to vote your shares online. If you received these proxy materials by mail, you can also vote by mail or telephone using the proxy card enclosed with these materials.

On the proxy card, you will find the names of the persons designated by the Company to act as proxies to vote your shares at the Annual Meeting. The proxies are required to vote your shares in the manner you instruct.

What shares are included on my proxy card?

If you are a registered shareholder, your proxy card(s) will show all of the shares of Company stock registered in your name with our Transfer Agent, Broadridge Corporate Issuer Solutions, Inc., on the Record Date, including shares in the Direct Stock Purchase and Sale Program administered for Air Products’ shareholders by our Transfer Agent. If you also have shares registered in the name of a bank, broker, or other registered owner or nominee, they will not appear on your proxy card.

How do I vote the shares on my proxy card?

If you received a Notice of Availability of Proxy Materials and accessed these proxy materials online, follow the instructions on the Notice to obtain your records and vote electronically.

If you received these proxy materials by mail, you may vote by signing and dating the proxy card(s) and returning the card(s) in the prepaid envelope. You also can vote online or by using a toll-free telephone number. Instructions

AIR PRODUCTS AND CHEMICALS, INC.

QUESTIONS AND ANSWERS ON VOTING AND THE ANNUAL MEETING

about these ways to vote appear on the proxy card. If you vote by telephone, please have your paper proxy card and control number available. The sequence of numbers appearing on your card is your control number, and your control number is necessary to verify your vote.

If you received these proxy materials via e-mail, the e-mail message transmitting the link to these materials contains instructions on how to vote your shares of Company stock and your control number.

Whether your proxy is submitted by mail, telephone, or online, your shares will be voted in the manner you instruct. If you do not specify in your proxy how you want your shares voted, they will be voted according to the Board’s recommendations below:

| 57 | ||

| APPENDIX A | A-1 | |

| Reconciliation of Non-GAAP Financial Measures | A-1 | |

| APPENDIX B | B-1 | |

| Survey Reference Group | B-1 |

Proxy Statement We have provided you this Notice of Annual Meeting and proxy statement because the Board of Directors (the “Board”) of Air Products and Chemicals, Inc. (the “Company” or “Air Products”) is soliciting your proxy to vote at the Company’s Annual Meeting of Shareholders on January 24, 2019 (the “Annual Meeting”). This proxy statement contains information about the items to be voted on at the Annual Meeting and information about the Company. Instructions on how to access this proxy statement and our 2018 Annual Report to Shareholders on the Internet or paper copies of the proxy statement and Annual Report are first being sent to shareholders on or about December 12, 2018. |

| x | 2019 Annual Meeting Proxy Statement |

Corporate Governance at Air Products |

How do I vote shares held by my broker or bank?

If a broker, bank, or other nominee holds shares of Company stock for your benefit, and the shares are not in your name on the Transfer Agent’s records, then you are considered a “beneficial owner” of those shares. If your shares are held this way, sometimes referred to as being held in “street name”, your broker, bank, or other nominee will send you instructions on how to vote. If you have not heard from the broker, bank, or other nominee who holds your Company stock, please contact them as soon as possible. If you plan to attend the meeting and would like to vote your shares held by a bank or broker in person, you must obtain a legal proxy, as described in the admission procedures section on page 4.

If you do not give your broker instructions as to how to vote, under New York Stock Exchange (“NYSE”) rules, your broker has discretionary authority to vote your shares for you on Item 4 to ratify the appointment of auditors. Your broker may not vote for you without your instructions on the other items of business. Shares not voted on these other matters by your broker because you have not provided instructions are sometimes referred to as “broker nonvotes”.

May I change my vote?

Yes. You may revoke your proxy at any time before the Annual Meeting by submitting a later dated proxy card, by a later telephone or on-line vote, by notifying us that you have revoked your proxy, or by attending the Annual Meeting and giving notice of revocation in person.

How is Company stock in the Company’s Retirement Savings Plan voted?

If you are an employee who owns shares of Company stock under the Retirement Savings Plan and you have regular access to a computer for performing your job, you were sent an e-mail with instructions on how to view the proxy materials and provide your voting instructions. Other participants in the Retirement Savings Plan will receive proxy materials and a proxy card in the mail. The Trustee, Fidelity Management Trust Company, will vote shares of Company stock allocated to your Plan account on the Record Date in accordance with the directions you give on how to vote. The Trustee will cast your vote in a manner which will protect your voting privacy. If you do not give voting instructions or your instructions are unclear, the Trustee will vote the shares in the same proportions and manner as overall Retirement Savings Plan participants instruct the Trustee to vote shares allocated to their Plan accounts.

AIR PRODUCTS AND CHEMICALS, INC.

QUESTIONS AND ANSWERS ON VOTING AND THE ANNUAL MEETING

What is a “quorum”?

A quorum is necessary to hold a valid meeting of shareholders. A quorum exists if a majority of the outstanding shares of Company stock are present in person at the Annual Meeting or represented there by proxy. If you vote —including by Internet, telephone, or proxy card — your shares voted will be counted towards the quorum for the Annual Meeting. Proxies marked as abstentions and broker discretionary votes are also treated as present for purposes of determining a quorum.

What vote is necessary to pass the items of business at the Annual Meeting?

ElectionBoard of Directors. Our Bylaws provide that if

Selection of Directors |

The Board has established the following minimum qualifications for all non-management directors:

✓Business experience ✓Judgment ✓Independence | ✓Integrity ✓Ability to commit sufficient time and attention to the activities of the Board | ✓Absence of any potential conflicts with the Company’s interests ✓An ability to represent the interests of all shareholders. |

While the Board has not adopted a quorum is present atformal policy on diversity, the Annual Meeting, the eight director candidates will be elected if they receive a majority of the votes cast at the meeting in person or by proxy. This means the nominees will be elected if the number of shares voted “for” the nominee exceeds the number of shares voted “against” the nominee. Abstentions and broker nonvotes are not counted as votes cast and therefore will have no effect.

Under our Corporate Governance Guidelines any incumbent director who is not reelected by(the “Guidelines”) provide that, as a majority of the votes cast must tender his or her resignation to the Corporate Governance and Nominating Committee ofwhole, the Board forshould include individuals with a diverse range of experiences to give the Board depth and breadth in the mix of skills represented. The Board seeks to include an array of skills, perspectives and experience in its consideration. The Corporate Governanceoverall composition. This guideline is implemented by seeking to identify candidates that bring diverse skills sets, backgrounds and Nominating Committee then recommendsexperiences, including ethnic, gender and geographic diversity, to the Board whether to accept the resignation. Thewhen director will continue to serve until the Board decides whether to accept the resignation, but will not participate in the Committee’s recommendation or the Board’s action regarding whether to accept the resignation. The Board will publicly disclose its decision and rationale within 90 days after certificationcandidates are needed.

| 1 |

All Other ItemsContents. The other three items of business will be approved if shares voted in favor of the proposal exceed shares voted against the proposal. Abstentions and broker nonvotes will not affect the outcome of the vote.

How will voting on any other business be conducted?

We do not know of any business or proposals to be consideredCorporate Governance at the Annual Meeting other than the items described in this Proxy Statement. If any other business is proposed and the chairman of the Annual Meeting permits it to be presented at the Annual Meeting, the signed proxies received from you and other shareholders give the persons voting the proxies the authority to vote on the matter according to their judgment.

When are Shareholder proposals for the Annual Meeting to be held in 2018 due?

To be considered for inclusion in next year’s proxy statement, proposals and nominations of persons to serve as directors must be delivered in writing to the Secretary of the Company, Air Products and Chemicals, Inc., 7201 Hamilton Boulevard, Allentown, PA 18195-1501 no later than August 16, 2017. To be presented at the 2018 Annual Meeting, proposals and nominations must be delivered in writing by October 30, 2017 and must comply with the requirements of our bylaws (described in the next paragraph).

Our Bylaws require adequate written notice of a proposal to be presented by delivering it in writing to the Secretary of the Company in person or by mail at the address stated above, on or after September 30, 2017, but no later than October 30, 2017. To be considered adequate, the notice must contain other information specified in the Bylaws about the matter to be presented at the meeting and the shareholder proposing the matter. A copy of our Bylaws can be found in the “Governance” section of our website atwww.airproducts.com. A proposal received after October 30, 2017, will be considered untimely and will not be entitled to be presented at the meeting.

The Board is composed of a diverse group of leaders in their respective fields. BOARD SNAPSHOT Independence Diversity Tenure 88% 50% 6.4 years Independent Diverse Average Tenure 7Independent 4Diverse 5Newer Directors (5 years or less) 1Not Independent 4Other 2Medium-Tenured Directors (6 to 10 years) 1Experienced Director (10+ years) BOARD QUALIFICATIONS AND SKILLS The Board believes that it is desirable that the following experience, qualifications and skills be possessed by one or more of Air Products’ Board members because of their particular relevance to the Company’s business and strategy: Accounting/Financial Reporting Executive Leadership Information Technology Logistics Experience Corporate Governance Finance and Capital Management International Experience Mergers & Acquisitions Diverse Director Government Experience Investor Relations Oil and Gas Experience Electronic Industry Industry/Operations Legal Corporate Governance at Air Products Information follows about the age and business experience Public Limited Company BackgroundWhat are the costs of this proxy solicitation?Many of theOur current directors have leadership experience at major domestic and international companies with operations inside and outside the United States and experience on other companies’ boards, which provideprovides an understanding of different business processes, challenges and strategies. OthersThey have substantial experience in key aspects of our operations, finance and capital management and government relations, or keyas well as in the market sectors which reflectwe serve, including the energy, electronics and chemicals industries. Our directors also possess extensive experience in functional areas that are important to the execution of their oversight responsibilities, including corporate governance, accounting and financial reporting, information technology, mergers and acquisitions, investor relations and legal affairs. We believe all of our customer base, or financial or governance expertise. Alldirectors have personal traits such as candor, integrity, commitment and collegiality that are essential to an effective board of directors.

Technology

2 2019 Annual Meeting Proxy Statement Director Biographies as of December 1, 2016, of the director nominees up for election and the particular experiences,experience, qualifications, attributes and skills that led the Board to conclude that each director should serve as a director. Each nominee has consented to being nominated for director and has agreed to serve if elected. All of the nominees are currently directors.

SUSANSusan K. CARTERCarter, age 58.Independent

Senior Vice President and Chief Financial Officer of Ingersoll-Rand Plc.of the Company since 2011.Since2011

Susan K. Carter is the Senior Vice President and Chief Financial Officer of Ingersoll-Rand Plc.,Public Limited Company, a diversified industrial company. She joined Ingersoll-Rand in September 2013. Prior to joining Ingersoll-Rand, from 2009 to 2013, Ms. Carter served as Executive Vice President and Chief Financial Officer of KBR, Inc., a global engineering, construction and services company; from 2009 to 2013, as Executive Vice President and Chief Financial Officer of Lennox International Inc, a global provider of climate control solutions for heating, air conditioning, and refrigeration marketsInc. from 2004 to 2009;2009 and as Vice President and Chief Accounting Officer of Cummins, Inc. from 2002 to 2004. She also has held senior financial and accounting roles at Honeywell International Inc., DeKalb Corporation and Crane Co. She is a former director of Lyondell Chemical Company. Ms. Carter received a Bachelor’s degree in Accounting from Indiana University and received a Master’s degree in Business Administration from Northern Illinois University. She is a Certified Public Accountant.As the chief financial officer of global publicly-held corporations, Ms. Carter has gained significant experience in financial reporting, information technology, accounting, finance and capital management, investor relations, and international operations. Her background provides the Board with broad expertise in international financial and operational issues.

| Qualifications Ms. Carter has significant experience in financial reporting, information technology, accounting, finance and capital management, investor relations and international operations due to her experience as chief financial officer for a series of global publicly held corporations. Her background provides the Board with broad expertise in international financial and operational issues, as well as significant understanding of financial reporting issues. |

|

| ||

Age71 | Committees | ||

Director | ●Audit and Finance ●Corporate Governance and Nominating | ||

Background

Charles “Casey” Cogut is Senior Mergers and Acquisitions (“M&A”) Counsel ata retired partner of Simpson Thacher & Bartlett LLP (“STB”). Mr. Cogut joined the New York-based law firm in 1973 and served as partner in STB from 1980-2012.1980 to 2012 and as a Senior Mergers and Acquisitions Counsel at STB from 2013 to 2016. For many years he was a leading member of STB’s M&Amerger and acquisitions and private equity practices. He specialized in domestic, international and cross-border mergers and acquisitions, the representation of special committees of boards of directors and buyouts and other transactions involving private equity firms. In addition, he regularly advised boards of directors with respect to corporate governance matters and fiduciary responsibilities. From 1990 –to 1993, he served as senior resident partner in the firm’s London office. Mr. Cogut received his J.D. in 1973 from the University of Pennsylvania Law School after graduating summa cum laude from Lehigh University in 1969. He is a member of the Board of Overseers of the University of Pennsylvania Law School;School and Co-Chair of the Board of Advisors of the University’s Institute for Law and Economics; and a member of the Law School’s adjunct faculty.Economics. He also is a memberdirector of The Williams Companies, Inc. and a Vice Chair of the Board of Trustees and a member of the Executive Committee of Cold Spring Harbor Laboratory.

Mr. Cogut brings to the Board expertise in governance and fiduciary responsibilities He was formerly a director of directors. He also has extensive experience in multi-jurisdictional mergers and acquisitions and other complex transactions. He is recognized as one of the leading corporate lawyers in the United States.

AIR PRODUCTS AND CHEMICALS, INC.

THE BOARD OF DIRECTORSPatheon N.V.

| Qualifications Mr. Cogut brings to the Board expertise in governance and fiduciary responsibilities of directors. He also has extensive experience in multi-jurisdictional mergers and acquisitions and other complex transactions. He has been recognized as one of the leading corporate lawyers in the United States. |

|

Corporate Governance at Air Products

| Chadwick C. DeatonIndependent Retired Chairman and Chief Executive Officer of Baker Hughes Inc. | ||

Age66 | Committees | ||

Director | ●Corporate Governance and Nominating (Chair) ●Executive ●Management Development and Compensation | ||

Background

Chadwick C.“Chad” Deaton is the retired Executive Chairman of Baker Hughes, Incorporated,Inc., an oilfield services and products provider with operations in over 90 countries. He joined Baker Hughes in 2004 and served as Chairman and Chief Executive Officer through 2011. He became Executive Chairman in January 2012. He2012 and retired as Executive Chairmanfrom that position in April 2013. Previously, Mr. Deaton was President and Chief Executive Officer of Hanover Compressor Company (now Exterran Holdings, Inc.); and Senior Advisor and Executive Vice President of Schlumberger Oilfield Services. Mr. Deaton is a director of Ariel Corporation, a private manufacturer of gas compressor equipment, CARBO Ceramics, Inc., Marathon Oil Corporation and Transocean Ltd. He is also a former director of Hanover Compression Company and Baker Hughes. He is a director of Houston Achievement Place and a member of the Society of Petroleum Engineers’, and the Governor of Wyoming’s Engineering Task Force for the University of Wyoming. He also serves as a director for the University of Wyoming Foundation. Mr. Deaton earned a Bachelor’s degree in Geology from the University of Wyoming.

As a former chairman and chief executive officer of a global publicly held corporation, Mr. Deaton brings to the Board international business experience and executive leadership experience in operations, technology, talent management, and governance. In addition, his 30-year career in petrochemicals and energy businesses provides him with expertise in key customer segments for the Company.

| Qualifications As a former chairman and chief executive officer of a global publicly held corporation, Mr. Deaton brings to the Board international business experience and executive leadership experience in operations, technology, talent management and governance. In addition, his 30-year career in petrochemicals and energy businesses provides him with expertise in key customer segments for the Company. |

| Seifollah (“Seifi”) Ghasemi Chairman, President and Chief Executive Officer of the | ||

Age74 | Committees | ||

Director | ●Executive (Chair) | ||

Background

Prior to joining Air Products, from 2001-2014,2001 to 2014, Mr. Ghasemi served as Chairman and Chief Executive Officer of Rockwood Holdings, Inc., a global leader in inorganic specialty chemicals and advanced materials that was acquired by Albemarle Corporation in January 2015. From 1997-2001,1997 to 2001, he held leadership roles at GKN, a global industrial company, including positions as director of the Main Board of GKN, plc and Chairman and Chief Executive Officer of GKN Sinter Metals, Inc. and Hoeganes Corporation. Earlier in his career, Mr. Ghasemi spent nearly 20 years with The BOC Group (the industrial gas company which is now part of Linde AG) in positions including director of the Main Board of BOC Group, plc; Presidentplc, president of BOC Gases Americas;Americas and Chairman and Chief Executive Officer of BOC Process Plants, Ltd. and Cryostar. He is a former director of Rockwood Holdings, Inc. and EnerSys. Mr. Ghasemi also serves as non-executive chairman of Versum Materials, Inc. Mr. Ghasemi earned his undergraduate degree from Abadan Institute of Technology and holds a Master’s degree in Mechanical Engineering from Stanford University.

Mr. Ghasemi brings to the Board strong leadership and extensive management and operating experience, including deep experience in the industrial gases and specialty chemicals industries, and a solid understandingalso was awarded an honorary Doctor of key end markets for the Company. His prior executive leadership of an international chemical company also provides substantial experience in governance and portfolio management, strategic planning, talent management, and international operations. He provides the Board with candid insights into the Company’s industry, operations, management team, and strategic strengths and weaknesses.

Science degree from Lafayette College.

| Qualifications Mr. Ghasemi brings to the Board strong leadership and extensive management and operating experience, including deep experience in the industrial gases and specialty chemicals industries, and a solid understanding of key end markets for the Company. His prior executive leadership of an international chemical company also provides substantial experience in governance and portfolio management, strategic planning, talent management and international operations. He provides the Board with candid insights into the Company’s industry, operations, management team and strategic strengths and weaknesses. |

4 |

Corporate Governance at Air Products

| David H. Y.

| ||

Age59 | Committees | ||

Director | ●Audit and Finance ●Management Development and Compensation | ||

Background

David H. Y. Ho is Chairman and Founder of Kiina Investment Ltd., a venture capital firm that invests in start-up companies in the technology, media and telecommunications industries. Mr. Ho previously served as Chairman of Greater China for Nokia Siemens Networks, President of Greater China for Nokia Corporation and Senior Vice President of the Nokia Networks Business Group. He has also held senior leadership roles with Nortel Networks and Motorola in China and Canada. Mr. Ho currently serves in the United States as a member of the boardsboard of Pentair PLCnVent Electric plc and Qorvo, Inc.

AIR PRODUCTS AND CHEMICALS, INC.

THE BOARD OF DIRECTORS

and in China as a member of the United States andboard of two Chinese state-owned enterprises: China COSCO Shipping Corporation and China Mobile Communications Corporation. Mr. Ho served as a director of Pentair plc prior to the separation of its electrical business now held by nVent Electric plc, a director of Triquent Semiconductor, Inc. prior to its merger with R. F. Micro Devices to form Qorvo, Inc., and as a director of China Ocean Shipping Company prior to its merger with China Shipping Group. Mr. Ho also previously served as a director of Dong Fang Electric Corporation and Owens Illinois, Inc. He holds a Bachelor’s degree in Engineering and a Master’s degree in Management Sciences from the University of Waterloo in Canada.

Mr. Ho has extensive experience establishing and building businesses in China and in international joint venture operations, government relations, and Asian operations and marketing. His background brings significant value to the Company as we execute on our Asian strategy. He also has executive leadership experience in the electronics and technology industries, key customer markets for the Company.

| Qualifications Mr. Ho has extensive experience establishing and building businesses in China and in international joint venture operations, government relations and Asian operations and marketing. His background brings significant value to the Company as we execute on our Asian strategy. He also has executive leadership experience in the electronics and technology industries, which are key customer markets for the Company. |

|

| ||

Age59 | Committees | ||

Director | ●Corporate Governance and Nominating ●Management Development and Compensation | ||

Background

Margaret G. McGlynn is the retired President of the Global Vaccine and Infectious Disease Division of Merck & Co., a global pharmaceutical company, where she worked for 26 years until her retirement in 2009. Following retirement, she served as President and Chief Executive Officer of International AIDS Vaccine Initiative, a global not-for-profit, public-private partnership working to accelerate the development of vaccines to prevent HIV infection and AIDS. She joined its board in 2010 and served as President and Chief Executive Officer from 2011 until her retirement in 2015. Ms. McGlynn previously served asAs President, Global Vaccine and Infectious Disease Division of Merck & Co., Inc., a global pharmaceutical company, from 20072006 until her retirement in 2009, where she was responsible for a portfolio of more than $7 billion in global sales. She led the introduction of several new vaccine products and anti-infective therapies, expanded Merck’s vaccine and infectious disease business globally and launched several initiatives to provide access to its vaccines and HIV therapies in the developing world. Earlier she served as President,She also led several other divisions, including U.S. Human Health at Merck, from 2003 to 2005, and in 2005 she was named President, Merck Vaccine Division.Hospital and Specialty Products and Global Marketing. Ms. McGlynn was a member of the Global Alliance for Vaccines and Immunization board of directors and executive committee from 2006 to 2008. She is also a director of Amicus Therapeutics, Inc., and Vertex Pharmaceuticals, Inc., Orphan Technologies Ltd., and She formerly served as a former director of Quidel Diagnostics. She earned a Bachelor’s degree in Pharmacy and a Master’s of Business Administration in Marketing from State University of New York at Buffalo.

From her management of a global pharmaceutical business and experience as chief executive officer of a global organization, Ms. McGlynn brings extensive experience in government relations and public policy, international marketing, mergers and acquisitions and talent management. She has expertise in productivity, and a deep understanding of the healthcare business, an important customer base for the Company. Her service on other boards also provides financial and governance experience.

| Qualifications From her management of a global business and service as chief executive officer of a global organization, Ms. McGlynn brings extensive experience in government relations and public policy, international marketing, mergers and acquisitions and talent management. She has expertise in productivity and a deep understanding of the healthcare business, an important customer base for the Company. Her service on other boards also provides financial and governance experience. |

|

Corporate Governance at Air Products

| Edward L.

| ||

Age68 | Committees | ||

Director | ●Audit and Finance ●Executive ●Management Development and Compensation (Chair) | ||

Background

Mr. Monser is currentlyrecently retired as the President of Emerson Electric Co., a global industrial controls products company. At the time of his retirement, Mr. Monser hashad more than 30 years of experience in senior operational positions at Emerson and has played key roles in globalizing the company, having held increasingly senior positions at the company, including Chief Operating Officer (2001-2015)(2001 to 2015), President of its Rosemount Inc. subsidiary (1996-2001),(1996 to 2001) and various operations, new product development, engineering and technology positions. Mr. Monser currently serves as a director of Vertiv, a private company that provides equipment and services for datacenters, and has been appointed as a director of Canadian Pacific Railway Ltd., effective December 17, 2018. He is Vice Chairman of the U.S.-India Business Council,Strategic Partnership Forum, a member of the Economic Development Board for China’s Guangdong Province and a past board memberformer director and past Vice Chairman of the U.S.-China Business Council. He holds a Bachelor’s degree in Electrical Engineering from the Illinois Institute of Technology and a Bachelor’s degree in Education from Eastern Michigan University.

As the former chief operating officer of a premier industrial organization, Mr. Monser provides the Board with a solid understanding of industrial operations, supply chain optimization, and continuous improvement; extensive experience in international business operations, particularly in emerging markets; and demonstrated capability in strategic planning and organizational development.

AIR PRODUCTS AND CHEMICALS, INC.

THE BOARD OF DIRECTORS

| Qualifications As former president and chief operating officer of a premier global industrial organization, Mr. Monser provides the Board with a solid understanding of industrial operations, supply chain optimization and continuous improvement, extensive experience in international business operations, particularly in emerging markets, and a demonstrated capability in strategic planning and organizational development. |

|

| ||

Age67 | Committees | ||

Director | ●Audit and Finance (Chair) ●Corporate Governance and Nominating ●Executive | ||

Background

Mr. Paull was Senior Executive Vice President and Chief Financial Officer of McDonald’s Corporation from 2001 until he retired from that position in 2008. Prior to joining McDonald’s in 1993, he was a partner at Ernst & Young where he managed a variety of financial practices during his 18-year career and consulted with many leading multinational corporations. Mr. Paull currently serves as a director of Canadian Pacific Railway Ltd. and Chipotle Mexican Grill Inc. He was formerly a director of KapStone Paper and Packaging Corporation. He was a former director ofCorporation and WMS Industries Inc. and the former lead director of Best Buy Co. He is a member of the Advisory Board of Pershing Square Capital Management, L.P. He also served as an advisory council member for the Federal Reserve Bank of Chicago. He holds a Master’s degree in Accounting and a Bachelor’s degree from the University of Illinois. He is a Certified Public Accountant.

| Qualifications Mr. Paull brings to the Board significant financial expertise with a deep understanding of financial markets, corporate finance, accounting and controls and investor relations. As a former chief financial officer of a multinational corporation, he also has extensive experience in international operations and marketing. |

| 6 | 2019 Annual Meeting Proxy Statement |

Corporate Governance at Air Products

| Director Independence |

| The Board has affirmatively determined that all of the Company’s directors, except Mr. Ghasemi, qualify as independent under the New York Stock Exchange (“NYSE”) corporate governance listing standards. In determining independence, the Board determines whether directors have a material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of directors. When assessing materiality, the Board considers all relevant facts and circumstances, including transactions between the Company and the director, family members of directors or organizations with which the director is affiliated. The Board further considers the frequency of and dollar amounts associated with any of these transactions and whether the transactions were in the ordinary course of business and were consummated on terms and conditions similar to those with unrelated parties. |

In its determination, the Board considers the specific tests for independence included in the NYSE listing standards. In addition, the Guidelines provide standards to assist in determining each director’s independence, which meet or exceed the NYSE independence requirements. The Guidelines provide that the following categories of relationships are immaterial for purposes of making an independence determination:

| ● | sales or purchases of goods or services between the Company and a director’s employer or an employer of a director’s family member, which occurred more than three years prior to the independence determination or involved less than 1% of such employer’s annual consolidated gross revenues, took place on the same terms and conditions offered to third parties or on terms and conditions established by competitive bid and did not affect the director’s or family member’s compensation; |

| ● | charitable contributions by the Company to an organization in which the director or his or her immediate family member serves as an executive officer, director or trustee that occurred more than three years prior to the independence determination, were made pursuant to the Company’s matching contributions program or were less than the greater of $1 million or 2% of the organization’s gross revenues; |

| ● | membership of a director in the same professional association, social, fraternal or religious organization or club as an executive officer of the Company; |

| ● | a director’s past matriculation at the same educational institution as an executive officer of the Company; |

| ● | a director’s service on the board of directors of another public company on which an executive officer of the Company also serves as a director, except for prohibited compensation committee interlocks; and |

| ● | a director’s service as a director, trustee or executive officer of a charitable or educational organization where an executive officer of the Company also serves as a director or trustee. |

In accordance with NYSE listing standards, in affirmatively determining the independence of any director who will serve on the Management Development and Compensation Committee, the Board also specifically considers factors relevant to determining whether a director has a relationship to the Company, which is material to that director’s ability to be independent from management in making judgments about the Company’s executive compensation, including sources of the director’s compensation and relationships of the director to the Company or senior management.

In addition, the Guidelines provide that no director may serve on the Audit and Finance Committee or Management Development and Compensation Committee of the Board if he or she has received within the past or preceding fiscal year any compensatory fee from the Company other than for Board or committee service; and no director may serve on the Management Development and Compensation Committee of the Board unless the director qualifies as an “outside director” under U.S. tax laws pertaining to deductibility of executive compensation.

On an annual basis, each member of the Board is required to complete a questionnaire designed in part to provide information to assist the Board in determining whether the director is independent under NYSE rules and the Guidelines. In addition, each director or potential director has an affirmative duty to disclose to the Corporate Governance and Nominating Committee relationships between and among that director (or an immediate family member), the Company and/or the executive officers of the Company.

| 7 |

Corporate Governance at Air Products

The Corporate Governance and Nominating Committee reviews director relationships and transactions for compliance with the standards described above and makes a recommendation to the Board, significantwhich makes the independence determination. For those directors identified as independent, the Company and the Board are aware of no relationships or transactions with the Company or management, which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Routine purchases and sales of products involving Ms. Carter’s and Mr. Monser’s employers (amounting to less than 1% of the Company’s and each such employer’s consolidated revenues) and Mr. Paull’s service on the advisory board of a shareholder were determined not to interfere with their independence.

| Board Refreshment | ||||

Ongoing Assessment of Board Composition The qualities and skills necessary for a specific director nominee are governed by the needs of the Company at the time the Corporate Governance and Nominating Committee determines to add a director to the Board. The specific requirements of the Company are determined by the Committee and are based on, among other things, the Company’s current business, market, geographic and regulatory environments; the mix of perspectives, experience and competencies currently represented by the other Board members; and the CEO’s views as to areas in which management desires additional advice and counsel. | Board Tenure Policy To enable Board succession planning and refreshment, the Board has adopted a policy that a non-executive director may not continue to serve on the Board after the Annual Meeting following the earlier of his or her completion of 15 full years of service on the Board or attainment of age 75. The Board retains the flexibility to waive this policy, including in response to events or recruiting realities. At the time Mr. Ghasemi was recruited to become the Company’s Chairman and CEO in 2014, the Board determined it would waive the age limit for him to enable him to remain a director during his employment. | |||

| ||||

Identification of Candidates When the need to recruit a non-management director arises, the Corporate Governance and Nominating Committee’s standard process is to consult the other directors, the CEO and sometimes a third-party recruiting firm to identify potential candidates. Once a candidate is identified, the candidate screening process typically is conducted initially through an interview by one or more members of the Committee and the CEO. | ||||

| ||||

Candidate Selection After the initial interviews, the candidate meets with the full Corporate Governance and Nominating Committee for formal consideration and recommendation to the Board. Prior to nomination or election, an investigation is conducted to verify the candidate’s reputation and background, the candidate’s independence as measured by the Board’s independence standards and other factors the Committee deems appropriate at the time. | ||||

| Shareholder Nominations |

The Corporate Governance and Nominating Committee has adopted a policy regarding its consideration of director candidates recommended by shareholders for nomination by the Board at an Annual Meeting and a procedure for submission of such candidates. The policy provides that candidates recommended by shareholders will be considered by the Committee. Submissions of candidates must be made in writing and must be received not later than 120 days prior to the anniversary date of the proxy statement for the prior Annual Meeting. The submission must also provide certain information concerning the candidate and the recommending shareholder(s), a statement explaining why the candidate has the qualifications required and consent of the candidate to be interviewed by the Corporate Governance and Nominating Committee and to serve if elected. A copy of the policy and procedure is available upon request from the Corporate Secretary’s Office. Candidates recommended by shareholders in accordance with these procedures will be screened and evaluated by the Corporate Governance and Nominating Committee in the same manner as other candidates.

| 8 | 2019 Annual Meeting Proxy Statement |

Corporate Governance at Air Products

| Overview |

Our business is managed by our employees under the direction and oversight of the Board. Among other responsibilities discussed below, the Board reviews, monitors and, where appropriate, approves fundamental financial expertiseand business strategies and major corporate actions. The Board of Directors is elected by shareholders to provide advice and counsel to and oversee management to ensure that the interests of the stockholders and other corporate constituents are being served with a deep understandingview toward maximizing our long-term value.

Directors exercise their oversight responsibilities through discussions with management, review of financial markets, corporate finance, accountingmaterials management provides to them, visits to our offices and controls,facilities and investor relations. Astheir participation in Board and Board committee meetings.

| Risk Oversight |

The CEO and other members of senior management are responsible for assessing and managing the Company’s risk exposure, and the Board and its committees provide oversight in connection with those efforts.

| The Board of Directors Responsibility for risk oversight rests with the Board. The Board formally reviews the Company’s risk management processes and policies periodically, including identification of key risks and associated monitoring, control and mitigation activities, but the Board primarily exercises its risk oversight responsibility through meetings, discussions and review of management reports and proposals. Consideration of risk is inherent in the Board’s consideration of the Company’s long-term strategies and in the transactions and other matters presented to the Board, including large capital expenditures, acquisitions and divestitures, cybersecurity and safety and environment updates. Committees help the Board carry out this responsibility by focusing on specific key areas of risk inherent in our business. All Board members are invited to attend most committee meetings, and Board members who do not attend committee meetings receive information about committee activities and deliberations. | ||||||||||||||||

|  | |||||||||||||||

|  |  | ||||||||||||||

Audit and Finance Committee | Corporate Governance and Nominating Committee The Corporate Governance and Nominating Committee oversees risks associated with corporate governance, including Board structure, director succession planning and allocation of authority between management and the Board. | Management Development and Compensation Committee | ||||||||||||||

Management | ||||||||||||||||

| 9 |

Corporate Governance at Air Products

| Management Succession Planning |

The Management Development and Compensation Committee of the Board, the CEO and the Human Resources organization maintain an ongoing focus on executive development and succession planning to prepare the Company for future success. The Board reviews organization and succession plans with our CEO at least annually. In addition, the Company has an emergency succession procedure for the CEO that is reviewed annually by the Board.

| A comprehensive review of executive talent determines readiness to take on additional leadership roles and identifies developmental and coaching opportunities needed to prepare our executives for greater responsibilities. | In addition to preparing for CEO succession, the succession planning process includes other senior management positions. | ||||||||

| |||||||||

|  | ||||||||

| Succession planning is a responsibility of the entire Board and all members participate in this process. | The CEO makes a formal succession planning presentation to the Board annually. | ||||||||

| |||||||||

| Shareholder Communications |

Shareholders and other interested parties may communicate with the independent directors by sending a former chief financial officerwritten communication in care of the Corporate Secretary to:

| Air Products and Chemicals, Inc. 7201 Hamilton Boulevard |

The Board has adopted a multinational corporation, hewritten procedure for collecting, organizing and forwarding direct communications from shareholders and other interested parties to the non-management directors. A copy of the procedure is available upon request from the Corporate Secretary’s Office.

| Board Leadership Structure |

The Board does not have a policy on whether the roles of Chairman of the Board and CEO should be separate or whether the Chairman of the Board should be independent. The Board determines which structure is in the best interests of the Company at any given time.

At present Mr. Ghasemi serves as both CEO and Chairman of the Board, and the Board also has extensive experiencean independent Lead Director. The Board decided to combine the CEO and Chairman roles because it has a high level of confidence in internationalMr. Ghasemi’s leadership and willingness to work closely and transparently with the independent directors. The Board believes the Company is best served at this time by unified leadership of operations and marketing.oversight of the Company, which ensures that the Board and management act with common purpose. Finally, the Board is satisfied that the independent directors have ample opportunities to execute their responsibilities independently through numerous executive sessions held throughout the year at both the Board and committee levels, substantial interactions with members of the management team other than the CEO and the leadership of the Lead Director and the committee chairs.

AIR PRODUCTS AND CHEMICALS, INC.

| 10 | 2019 Annual Meeting Proxy Statement |

COMPENSATION OF DIRECTORS

Table of ContentsCOMPENSATION OF DIRECTORS

For fiscal year 2016,Corporate Governance at Air Products

| Lead Director |

The Lead Director is elected by majority vote of the Board upon the nomination of the Corporate Governance and Nominating Committee.

Mr. Deaton is currently the Lead Director.

| The Guidelines provide that the Lead Director’s responsibilities include: | |

| ● | presiding at executive sessions of the Board and any other time the Chairman is not present and communicating feedback to the CEO; |

| ● | determining the agenda for executive sessions of non-management directors; and |

| ● | principal authority to convene a meeting of independent directors. |

| Executive Sessions |

The independent directors regularly meet without the CEO or other members of management present in executive sessions that are scheduled at each Board meeting. In addition, the CEO performance review is conducted in executive session, and the Board committees regularly meet in executive session. Board executive sessions are led by the Lead Director, except the CEO performance review is led by the Chair of the Management Development and Compensation Committee.

| Standing Committees of the Board |

The Board has three standing committees, which operate under written charters approved by the Board: Audit and Finance; Corporate Governance and Nominating; and Management Development and Compensation. In accordance with NYSE listing standards, none of the directors who were notserve on the Audit and Finance, Corporate Governance and Nominating or Management Development and Compensation Committees have ever been employed by the Company, received an annual cash retainer for Board service of $100,000. Committee chairs received an additional retainer of $15,000 and the Board has determined in its business judgment that all of them are “independent” from the Company and its management in accordance with the guidelines described above in “Director Independence” as well as with additional NYSE listing criteria that are applicable to members of the Audit and Finance and Management Development and Compensation Committees. The Company’s Bylaws also provide for an Executive Committee.

| The charters of all the committees can be viewed on the Company website at www.airproducts.com/Company/governance/board-of-directors/commitee-descriptions-and-charters.aspx and are available in print to any shareholder upon request. |

| 11 |

Corporate Governance at Air Products

Audit and Finance Committee

Members ●Matthew H. Paull (Chair) ●Susan K. Carter ●Charles I. Cogut ●David H. Y. Ho ●Edward L. Monser The Board has determined that all of the Audit and Finance Committee members are “financially literate” and that Ms. Carter and Mr. Paull qualify as “audit committee financial experts” as defined by U.S. Securities and Exchange Commission (“SEC”) regulations and NYSE listing standards. FY2018 Meetings:8 | The Audit and Finance Committee operates under a written charter. Primary Responsibilities ●The Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit the Company’s financial statements. ●The Committee provides oversight of the Company’s external financial reporting process, systems and processes relating to the integrity of financial statements, internal audit process, programs for compliance with laws and regulations and the employee code of conduct, and processes for risk assessment and management. ●The Committee discusses with the Company’s internal auditor and independent registered public accountant the overall scope and plans for their respective audits. The Committee regularly meets with Internal Audit and the independent registered public accounting firm, with and without management present, to discuss the results of their audits, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. |

Corporate Governance and Nominating Committee

Members ●Chadwick C. Deaton (Chair) ●Charles I. Cogut ●Margaret G. McGlynn ●Matthew H. Paull FY2018 Meetings:2 | The Corporate Governance and Nominating Committee operates under a written charter. Primary Responsibilities ●The Committee monitors and makes recommendations to the Board about corporate governance matters, including the Guidelines, codes of conduct, Board structure and operation, Board policies on director compensation and tenure, the meeting schedules of the Board and its committees, the charters and composition of the committees and the annual Board and committee performance assessment processes. ●The Committee has primary responsibility for identifying, recommending and recruiting nominees for election to the Board and recommending candidates for election as Lead Director. ●The Committee also reviews and monitors the Company’s crisis management procedures, government relations activities and response to significant public policy issues, including social responsibility matters. |

| 12 | 2019 Annual Meeting Proxy Statement |

Corporate Governance at Air Products

Management Development and Compensation Committee